Two ways to think about taxes. Everyone should pay a portion of their income (as small as possible) to ensure that defense and infrastructure needs are met or…

the tax code should be used to press the agenda of whatever the current whim of the US Congress is – ie tax credits.

Tax credits also inflate the cost of the product they are incentivizing or artificially support what would otherwise be a nonviable product.

I am for the elimination of most tax credits (targeted) in exchange for the overall reduction and simplification of taxes for everyone (broad)

Reducing taxes on corporations is NOT a “give-away” for nasty corporations it is an expense reduction to YOUR employer that allows for better margins and increased profitability that benefits you as an employee and as a consumer. Corporations in the US are taxed higher than any other industrialized nation at 35%.

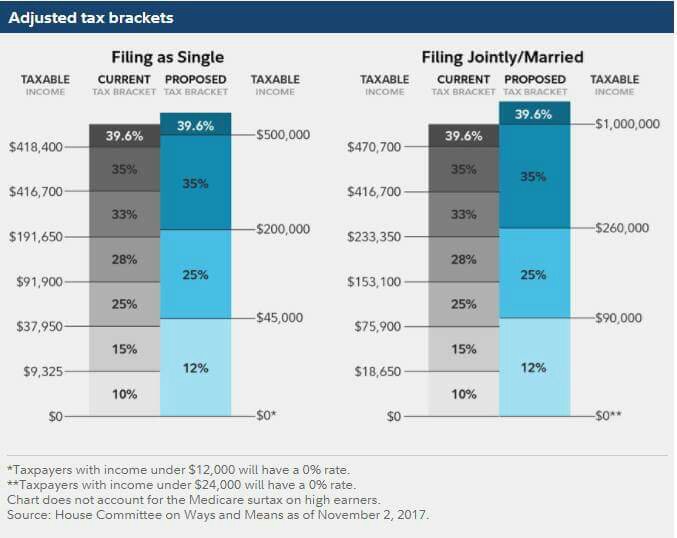

Eliminating a 500 dollar teacher’s credit, or housing interest deductions or electric car credit or student loan interest or state taxes while 1) doubling the standard deduction 2) increasing the child tax credit to 1600 (to offset the loss of the 4000 exemption) 3) lowering significantly the tax rate for nearly everyone 4) eliminating the Alternative Minimum Tax 5) Making it much simpler to file (no milage records to keep, no need for most people to itemize) These changes more than offset any loss from tax credits – How does that not make sense?

The sacred “adoption credit” This is a more significant loss because it is such a large credit but here are some questions for all those waxing eloquent on the evils of removing this credit. 1) Why do you believe your neighbor should be required to pay anything via taxes for you to adopt a child? 2) What percent should your neighbor be forced to pay in order for your moral outrage to go down – 100% 75% 10%? 3) What was the cost of adoption before the government began subsidizing it? 4) Why do you believe that funneling your money through the government for adoption is MORE efficient than having your friends and family have more disposable income to aid with the cost of adoption?

A simplified code and reduction in actual taxes paid and removal of special credits for the elite in Washington’s agenda (even those I agree with) is a great proposal regardless of the fact that Donald Trump proposed it.